janinadevlin5

About janinadevlin5

Understanding No Credit Score Verify On-line Loans: A Comprehensive Case Study

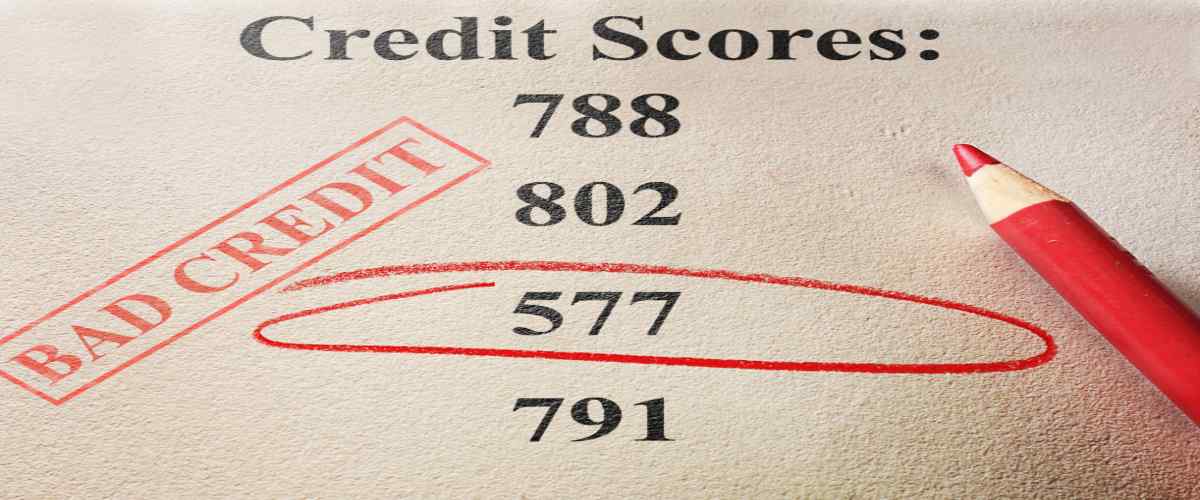

In at the moment’s financial landscape, obtaining a mortgage can be a daunting task, particularly for people with poor or no credit historical past. Traditional lenders often rely heavily on credit scores to evaluate the danger of lending, leaving many potential borrowers in a difficult place. Nonetheless, the emergence of no credit test online loans has offered a lifeline for many who may have been excluded from conventional financing choices. This case research explores the concept, benefits, drawbacks, and the general influence of no credit score examine on-line loans on customers and the monetary market.

The Idea of No Credit Verify Online Loans

No credit check online loans are monetary merchandise that enable borrowers to entry funds without undergoing a standard credit score evaluation. Here is more about www.bestnocreditcheckloans.com have a look at the web page. Lenders offering these loans usually concentrate on different components, akin to earnings, employment standing, and checking account information, to guage the borrower’s skill to repay the mortgage. These loans are sometimes marketed as a fast and simple solution for individuals in urgent want of money, corresponding to for medical emergencies, car repairs, or unexpected payments.

The Rise of No Credit score Verify Loans

The rise of on-line lending platforms and fintech companies has considerably changed the lending landscape. With the comfort of technology, borrowers can apply for loans from the consolation of their properties, usually receiving funds inside a brief period. In keeping with a report by the consumer Financial Safety Bureau (CFPB), the demand for no credit check loans has surged, particularly among youthful borrowers and those with restricted entry to conventional banking services.

As an example, a case research performed by the Financial Know-how Affiliation (FTA) highlighted that a big proportion of borrowers in search of no credit score check loans were beneath the age of 35 and were usually employed in gig economic system jobs. These people confronted challenges in acquiring credit score from traditional banks due to their non-traditional revenue sources and lack of credit historical past.

Advantages of No Credit score Examine Loans

- Accessibility: One in all the primary advantages of no credit score test loans is their accessibility. Borrowers with poor credit score scores or no credit historical past can often qualify for these loans, making them a beautiful choice for many who would otherwise be denied credit score.

- Speed: The online software course of is usually streamlined, permitting borrowers to obtain funds quickly, generally within hours. This velocity is essential for individuals facing pressing monetary needs.

- Less Stringent Necessities: In contrast to conventional loans that will require extensive documentation and a lengthy approval course of, no credit examine loans often have fewer necessities, making them simpler to acquire.

- Flexible Use: Borrowers can use the funds from no credit check loans for numerous purposes, including debt consolidation, medical expenses, or unexpected emergencies.

Drawbacks of No Credit Test Loans

Whereas no credit check loans offer a number of benefits, in addition they include significant drawbacks that borrowers ought to consider:

- High Curiosity Rates: One of many most important downsides of no credit score test loans is the excessive interest charges related to them. Lenders typically compensate for the chance of lending to borrowers with poor credit score by charging exorbitant rates, which may lead to a cycle of debt.

- Brief Repayment Phrases: These loans usually include quick repayment phrases, usually requiring borrowers to pay back the mortgage inside a couple of weeks or months. This can create financial pressure, especially if the borrower is unable to repay the loan on time.

- Potential for Predatory Lending: Some lenders could interact in predatory practices, focusing on susceptible borrowers and trapping them in a cycle of debt. It is crucial for borrowers to analysis lenders completely and understand the terms and conditions before taking out a loan.

- Impact on Credit Rating: While these loans don’t require a credit score examine, failing to repay them on time can negatively influence a borrower’s credit rating, resulting in additional monetary difficulties in the future.

Case Research: A Borrower’s Expertise

As an instance the influence of no credit test on-line loans, consider the case of Sarah, a 28-year-previous freelance graphic designer. Sarah had been struggling to make ends meet as a result of inconsistent earnings and an absence of credit score history. When her automotive broke down unexpectedly, she wanted $1,500 to cover the repair costs. With no savings and a poor credit score score, Sarah turned to a web-based lender providing no credit score examine loans.

The applying course of was quick and easy. Within half-hour, Sarah received approval for the mortgage and the funds were deposited into her account the subsequent day. However, the mortgage got here with a 30% interest rate and a repayment time period of just 30 days. Whereas Sarah was relieved to have the funds for her automobile repairs, she quickly realized that the high curiosity meant she would owe $1,950 by the top of the month.

Because the repayment date approached, Sarah discovered herself struggling to provide you with the funds. She took on further freelance work, but it surely was not enough to cover the mortgage payment. Finally, Sarah needed to take out another loan to repay the primary one, main her right into a cycle of debt that took months to escape.

Conclusion

No credit score examine on-line loans can provide a useful answer for people with poor credit or no credit score history, offering quick access to funds in instances of need. However, borrowers should method these loans with caution, understanding the potential dangers and penalties. It is important to conduct thorough research, evaluate lenders, and consider different options before committing to a no credit score check loan. As the market for these loans continues to develop, both borrowers and lenders must navigate the balance between accessibility and accountable lending practices to make sure a good and sustainable financial ecosystem.

No listing found.

Compare listings

Compare